House Title Loans Comprehensive Guide, Benefits, and Real-Life Examples

House title loans are a form of secured lending where homeowners use the title of their property as collateral to access quick financing. Unlike unsecured loans that rely mainly on credit history, these loans are backed by the value of the house, giving lenders greater confidence in repayment.

In practice, a borrower pledges their house title to the lender. If the borrower fails to repay the loan as agreed, the lender has the legal right to claim ownership or initiate foreclosure proceedings. This makes the loan less risky for lenders but riskier for borrowers, as the house itself is at stake.

House title loans are commonly used when individuals need immediate access to cash, often for emergencies or major expenses. The loan amount depends on the property’s market value, outstanding mortgage (if any), and the borrower’s repayment ability.

How House Title Loans Work

The process usually begins when a homeowner applies with a lender who specializes in secured financing. The lender evaluates the property’s value, reviews existing debts, and checks the borrower’s financial status. Once approved, the borrower signs over temporary rights to the house title until the loan is fully repaid.

Repayments are often structured into fixed monthly installments with an agreed-upon interest rate. If the borrower keeps up with payments, the title is returned once the loan is cleared. If not, the lender can enforce their legal right to repossess or sell the property.

This structure allows lenders to offer higher loan amounts and lower interest rates compared to unsecured borrowing. However, it also requires borrowers to carefully assess their repayment capacity before committing.

Benefits of House Title Loans

House title loans offer several unique advantages for borrowers who need substantial funds. First, they provide access to larger amounts of money, since the loan is tied directly to the property’s value. This makes it easier for borrowers to cover significant expenses compared to personal loans or credit cards.

Second, they come with potentially lower interest rates. Because the house title reduces the lender’s risk, the cost of borrowing is often less than unsecured options. This makes long-term repayment more affordable.

Third, these loans can be accessible even to borrowers with weaker credit histories. While lenders still consider repayment ability, the emphasis on property value allows more individuals to qualify.

Finally, title loans provide financial flexibility. Funds can be used for emergencies, debt consolidation, education, or even business growth, giving homeowners more control over how they manage their finances.

Real-World Examples of House Title Loans

Example 1: Emergency Medical Expenses

Consider a homeowner facing an urgent medical situation requiring $40,000 in treatment costs. Insurance covers only a portion, leaving a significant gap. By securing a house title loan, the homeowner can access the needed funds within days.

This solution ensures timely medical care without relying on high-interest credit cards. While it introduces repayment obligations, it provides an immediate lifeline during critical circumstances.

Example 2: Debt Consolidation Strategy

A borrower juggling multiple credit card debts at interest rates above 18% decides to consolidate using a house title loan. With $25,000 secured against their property, they pay off all existing debts and restructure repayment into one fixed monthly installment.

This reduces their financial stress, lowers total interest costs, and creates a clearer path toward becoming debt-free. By leveraging the house title, they turn multiple chaotic obligations into a manageable repayment plan.

Example 3: Business Expansion for Entrepreneurs

A small business owner needs capital to expand operations but struggles to get approved for unsecured business loans. By using their home title as collateral, they secure $75,000 in funding.

The money is invested in new equipment, inventory, and marketing campaigns. Within a year, the business sees a significant increase in revenue, allowing the owner to comfortably repay the loan while strengthening their long-term growth.

Example 4: Home Renovation and Value Growth

A family plans to renovate their outdated property with a new kitchen, roof repairs, and landscaping. They borrow $50,000 through a house title loan, using the funds to upgrade their living space.

Not only does this improve their quality of life, but it also increases the property’s resale value. In this case, the loan serves as both a financing tool and an investment in the family’s future financial security.

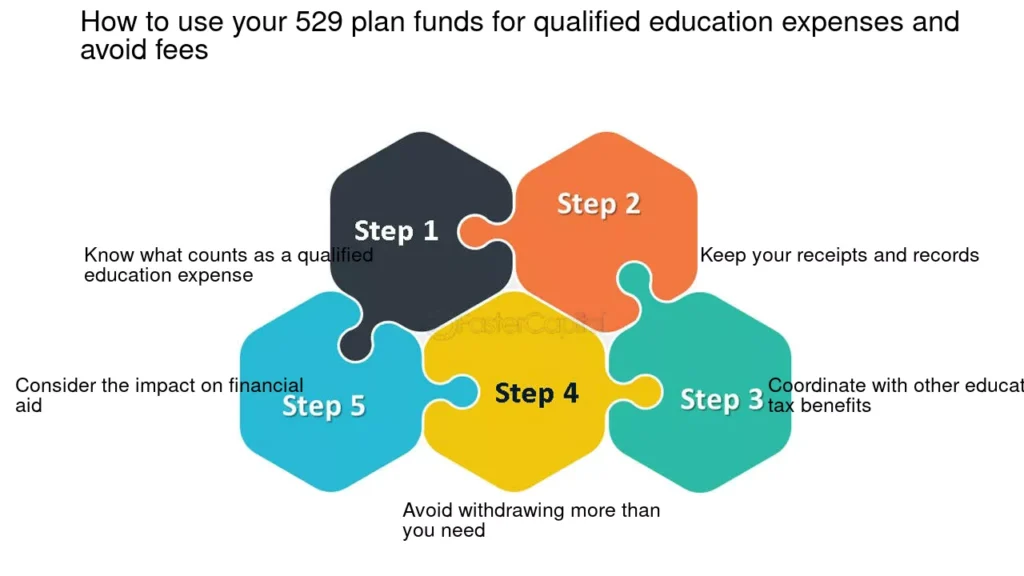

Example 5: Covering Educational Expenses

Parents planning to send their child abroad for university face steep tuition and living costs. Instead of liquidating retirement savings, they choose a house title loan to access $60,000.

This provides the flexibility to support their child’s education while maintaining other financial goals. The structured repayment plan ensures costs are spread out, reducing the immediate burden.

Practical Use Cases and Problem-Solving Benefits

House title loans address specific financial challenges where quick and significant funds are necessary. Their real-world value is seen in several scenarios:

-

Urgent Medical Bills: When treatment cannot wait, these loans provide immediate liquidity.

-

Debt Relief: High-interest debts can be replaced with a more affordable structured loan.

-

Investment in Property: Renovations increase both comfort and resale value.

-

Business Funding: Entrepreneurs can access growth capital when other financing is limited.

-

Education Support: Families can fund higher education without exhausting savings.

By tying financing to the value of a property, homeowners gain access to resources that might otherwise remain locked in their equity.

Risks and Considerations

Despite their benefits, house title loans carry significant risks. The most serious is potential loss of the property if the payment obligations are not met. Defaulting on a secured loan can lead to foreclosure, leaving the borrower without their home.

Additionally, while interest rates are often lower than unsecured loans, they can still be high depending on the lender and borrower’s profile. Borrowers should carefully calculate affordability before committing.

Another consideration is the long-term financial impact. Using a property title to secure short-term needs may create challenges if the borrower later faces income instability. Responsible planning is essential to avoid financial distress.

Frequently Asked Questions

1. How is a house title loan different from a mortgage?

A mortgage is primarily used to buy a home, while a house title loan allows homeowners to borrow against the equity of an already-owned property. Both use the property as collateral, but their purposes and structures differ.

2. Can I get a house title loan if I still have a mortgage?

Yes. As long as you have sufficient equity in your property, lenders may approve a house title loan. However, the existing mortgage will be considered when calculating the available loan amount.

3. Are house title loans a good option for people with poor credit?

They can be, since lenders place more emphasis on property value than on credit score. However, borrowers must ensure they can keep up with repayments to avoid the risk of losing their home.