No Appraisal Refinance Complete Guide and Benefits

A no appraisal refinance is a type of mortgage refinancing option that allows homeowners to replace their current loan with a new one without requiring a home appraisal. Normally, lenders need an appraisal to confirm the property’s current market value. However, with no appraisal refinance, the process skips this step.

This option is particularly attractive for homeowners who want to refinance quickly, avoid additional costs, or whose property value may not have increased significantly. It offers both convenience and financial flexibility.

Why Lenders Offer No Appraisal Refinance

Mortgage lenders may allow no appraisal refinance through specific programs like Fannie Mae’s High LTV Refinance Option or Freddie Mac’s Enhanced Relief Refinance. These programs aim to help borrowers lower their interest rates or monthly payments, even if their property value has not changed much.

By waiving the appraisal requirement, lenders streamline the process and reduce costs for both the homeowner and themselves.

Benefits of No Appraisal Refinance

Faster Processing Time

Skipping the appraisal speeds up the refinancing process. Typically, appraisals can take a week or longer, depending on market demand. Without it, homeowners can close the refinance much faster, which is useful when interest rates are changing rapidly.

Lower Costs

A home appraisal usually costs between $300 and $600. Eliminating this expense helps homeowners save money upfront. This makes refinancing more affordable and reduces the overall barrier to starting the process.

Accessibility for Homeowners with Limited Equity

For homeowners who have little equity in their property, a no-appraisal refinance provides a way to still access better loan terms. This can be especially valuable in cases where home prices have not risen or have even dropped.

Real-World Examples of No Appraisal Refinance

Example 1: Fannie Mae’s High LTV Refinance Option

Fannie Mae designed this program for homeowners who have high loan-to-value (LTV) ratios. If you owe more than your home’s current market value, traditional refinancing may not work. With the High LTV Refinance Option, you may qualify for better interest rates without an appraisal.

This option is particularly helpful for borrowers who purchased homes during peak market prices but have since seen property values stagnate.

Example 2: Freddie Mac’s Enhanced Relief Refinance

Freddie Mac offers another no-appraisal refinance solution targeted toward borrowers with limited equity. The program allows refinancing even if your LTV ratio is too high for standard loans. It helps homeowners who might otherwise be stuck with unfavorable loan terms.

This makes refinancing more accessible for families who experienced a drop in home value but still want financial relief.

Example 3: FHA Streamline Refinance

The FHA Streamline Refinance is available to borrowers with existing FHA loans. One of its biggest advantages is that it does not always require an appraisal. This feature allows homeowners to refinance into a lower interest rate or shorter term without having to worry about property value changes.

For borrowers with FHA-backed mortgages, this is a cost-effective and fast refinancing path.

Example 4: VA Interest Rate Reduction Refinance Loan (IRRRL)

The VA IRRRL program provides military service members, veterans, and eligible spouses with a streamlined refinancing option. Typically, it does not require an appraisal. This makes it faster and simpler for veterans to secure better loan terms.

The program recognizes the unique financial needs of service members, offering them a reliable way to improve their mortgage without unnecessary delays.

Practical Use Cases

When Home Values Decline

If property values in your neighborhood have dropped, a no-appraisal refinance lets you still qualify for refinancing. This prevents homeowners from being locked into unfavorable terms.

When You Need Quick Approval

Homeowners facing financial stress or trying to lock in lower rates quickly benefit from no appraisal refinance since it speeds up the approval process.

When You Want to Lower Monthly Payments

Borrowers who want to reduce their monthly mortgage payments can use this option without worrying about whether their home value supports the new loan.

When You Have Limited Equity

Even with little equity in the property, you can still refinance through programs that waive the appraisal requirement. This makes refinancing more inclusive and practical.

Key Advantages of Using Technology in No Appraisal Refinance

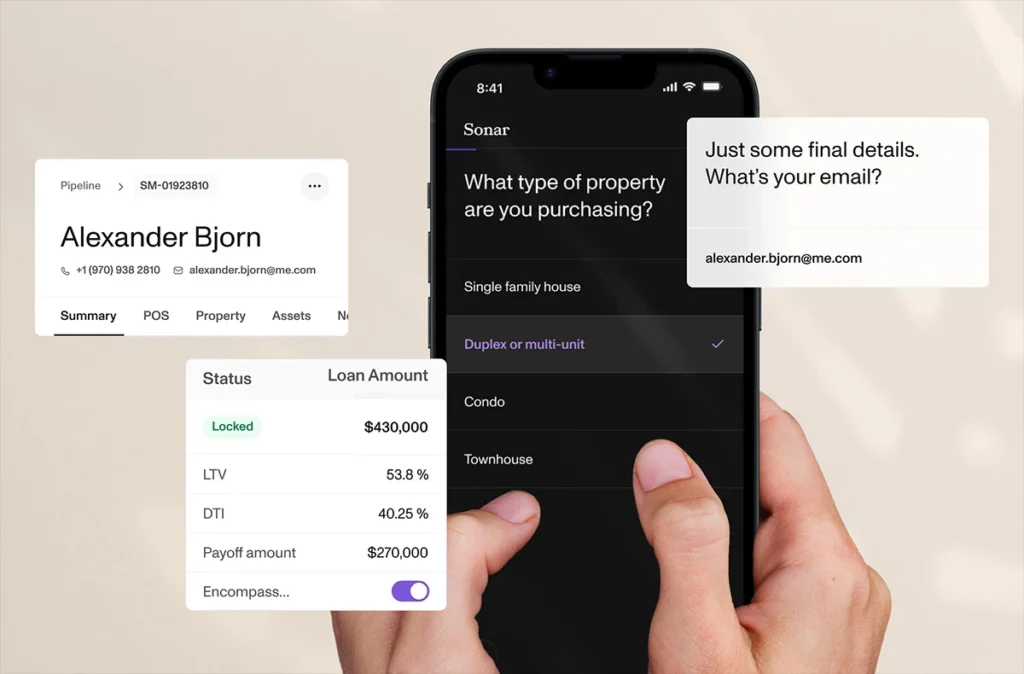

Modern lending platforms use automated valuation models (AVMs) and big data analytics to determine eligibility for no appraisal refinance. This reduces human error and speeds up processing.

Borrowers can also apply for refinancing online, upload documents digitally, and track their application status in real time. These technological improvements make the process more transparent and efficient.

Frequently Asked Questions

1. Who qualifies for a no appraisal refinance?

Eligibility depends on the type of loan program, your mortgage payment history, and whether your loan is backed by entities like Fannie Mae, Freddie Mac, FHA, or VA.

2. Does a no appraisal refinance affect my loan terms?

No, the loan terms depend on the lender’s program. Skipping the appraisal does not mean you get worse terms—it often means you can refinance more quickly and affordably.

3. Can I use no appraisal refinance if my home value has dropped?

Yes. That’s one of the main benefits of this option: it allows refinancing even when your property value has declined or you have little equity.